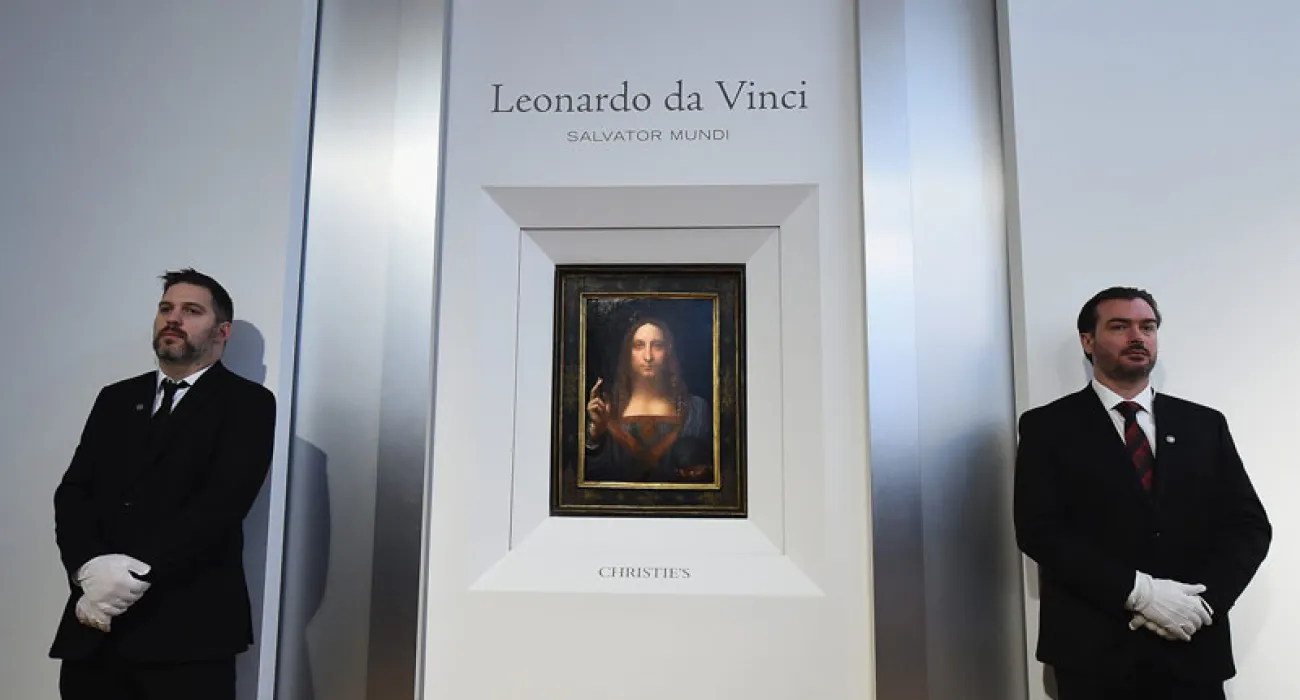

Leonardo da Vinci’s painting, “Saviour of the World,” sold for $450,312,500 Wednesday at auction, Christie’s said. The price, which includes a buyer’s premium, makes it “the most expensive painting ever sold at auction,” the auction house said in a recent statement.

The previous record for the most expensive painting sold at auction was $179,364,992 for Picasso’s “Les Femmes d’Alger” (“Women of Algiers”), according to Christie’s. The highest price previously paid at auction for a da Vinci was in 2001 for his “Horse and Rider,” a work on paper, which went for $11,481,865. This begs the question about whether or not it is a good idea to add collectibles into your overall portfolio and which collectibles may make sense if you have no real interest in collecting anything at all.

With all of the hoopla going on this year in California, one might stop and think that fine wine could be a good collectible as part of your overall holdings. In fact according to The Knight Frank Luxury Index, wine was the number one collectible performing investment over the past year returning 24% for investment grade fine wine. What’s more interesting is that specifically California wine returned 440% according to the same index over the past 10 years. Burgundy wine came in 4th over the past 10 years and collectible investment grade champagnes came in 7th over the past 10 years.

It’s probably not surprising at all with the aging of the baby boomers that Collectible Cars were actually number one performing collectible over the past decade. While many of us are starting to see more muscle cars back on the road including the Chevelle and others, the number two and number three highest performing car collectible over the past decade where Porsche and Ferrari. For classic cars, “2016 was the year of the slowdown,” says HAGI’s Dietrich Hatlapa. For anybody not familiar with the market, that looks like a slightly downbeat claim as annual growth was still a very respectable 9%. But set against total growth of 151% over the past five years, it is clear that the market has dropped down a few gears. “Those who were in it just for the money have moved on,” says Mr Hatlapa. “The market is now more in the hands of the collectors and specialists, which I think is good news for the real enthusiast.”

For those of you who own furniture and watches as collectibles, the news isn’t stellar at all. Furniture finishing at the absolute bottom last year down 31% and also at the absolute bottom over the past 10 years. What’s most interesting in the genre of watches is getting a handle on navigating which watches will potentially perform well and which ones will likely not maintain their value. Many people believe the good watches will increase in value when sometimes the opposite is true. Rolex, which is one of the most worn luxury watches by men and women actually finished behind Cartier and Patek Phillippe in overall value increase over the past 10 years.

Check Out The Complete Report here on all of the asset classes, but you consider carefully what you invest in with your collectibles if you think you’ll be a reseller in the future. $450 million dollars is quite a high price to fetch for one single painting, so if you don’t have that kind of loot you might stick to wine and collectible cars.